Data has become the lifeblood of the life sciences industry, powering everything from clinical trials and regulatory filings, to precision medicine and digital therapeutics. Yet as data volumes grow, so do the challenges of managing, protecting, and deriving value from it.

Drawing on my experience as a former CISO at a $12B biopharma and an industry analyst at Forrester, I’ve seen firsthand how organizations struggle to balance innovation with security, compliance, and governance. The real opportunity lies in transforming data from a byproduct of operations into a strategic asset that drives scientific discovery and business growth. While at Forrester, I focused on issues of importance to the Chief Information Security Officer. Most of my colleagues worried about the technical aspects of the network, operating system, and application security. I touched on those as well; however, I focused on management issues, such as what a modern cybersecurity team looks like, as well as the financials of cybersecurity. Why does any company need to protect its information assets? If they believe they do, is there a quantitative rationale for such protection?

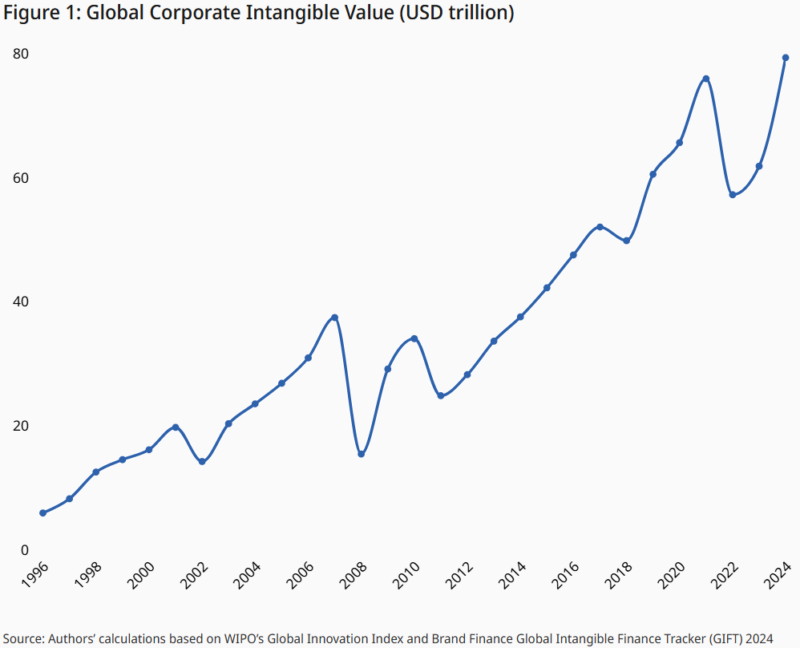

The answer became clear when I researched large corporations’ balance sheets. What I found is that for a vast majority of large organizations, the makeup of the assets on their balance sheet is what financial analysts term intangibles.

According to International Financial Reporting Standards (IFRS), intangibles are assets without physical substance.. However, companies expect intangible assets to generate economic returns for the company in the future. As a long-term asset, this expectation extends for more than one year or one operating cycle [1]. The IFRS word choice is interesting: “non-monetary assets without physical substance.” Yet, these are still assets and in balance perhaps the most valuable of all.

This is especially true for life sciences companies; information security isn’t just about protecting networks or applications, it’s about safeguarding intellectual property, patient data, and clinical trial integrity. Most assets on a biopharma’s balance sheet are intangible — data, IP, and other non-physical assets that generate future economic value. Protecting and maximizing the value of these assets is critical for long-term success.

The World Intellectual Property Organization estimates that the global value of all intangible assets has surpassed 80 trillion US dollars worldwide [2].

In the same report, the authors note that technology and pharmaceutical companies continue to dominate among the most intangible asset-rich firms. Life sciences companies that made the top firm list include Novo Nordisk, AstraZeneca, and Teva Pharmaceuticals [2].

So, what can we get from this information? Data represents a vast share of the wealth in the modern economy. Learning to leverage this asset is a critical success factor for all life sciences companies. Other businesses must master the discipline of data value creation.

Life sciences companies are now looking at new frontiers for the creative use of data in multiple areas. Let’s look at two important ones. I will cover additional dimensions in subsequent posts.

Research & Development (R&D)

Data has always been intrinsic to the research and development process for life sciences. For example, analyzing the results of a clinical trial can involve the collection of large samples of patient data, their disease response to the new medication, and, equally important, how this compares to patient responses who received a placebo during the trial.

“All clinical trials and many observational studies have a designated primary outcome of interest, which is the quantitative metric used to determine the effect of the treatment or exposure. The statistical properties, such as the probability distribution of the outcome variable and quantifying changes in said variable due to the exposure, are of primary importance in determining the choice of statistical methodology.” [3]

Artificial Intelligence is now impacting R&D as life sciences companies seek to find more cost-effective methods to bring drugs to market. Data science has emerged as a cornerstone for decision-making and problem-solving across various sectors, with potentially transformative implications for life sciences and healthcare organizations. Sloan Partners, a life sciences executive search firm, reports that the ability to analyze vast amounts of data accurately and quickly to extract meaningful insights has revolutionized how we approach scientific research and development, clinical practices, diagnostics, drug development, and patient care. [4]

Medical Affairs (Pharmaceutical Market Influence)

Another example is Medical Affairs. Medical Science Liaisons engage healthcare providers (HCPs) and Key Opinion Leaders (KOLs) to share scientific information and build relationships with these influencer groups.

Using various types of data to leverage medical affairs information for better patient outcomes:

- Harnessing real-world data and clinical insights.

- Influence physician prescribing behaviors

- Payer decisions

- Market access and reimbursement strategies

Using this information, life sciences companies judge market perceptions as well as measure the effectiveness of their medications in the marketplace.

I chose just two possible areas where data is critical to life sciences organizations. There are other use cases where data is essential for life sciences organizations. Other examples include finance, facilities, operations, manufacturing, sourcing, and logistics.

Using just these examples, it is obvious why information and data assets represent a significant part of a life sciences company’s balance sheet.

Green Leaf Consulting Group brings hands-on experience in helping life sciences companies harness the power of data within research and development and medical affairs. From ensuring data integrity in clinical research to delivering compliant, insight-rich reporting for medical affairs teams, they help organizations turn data into a strategic advantage that advances science and enhances patient care.

In this series of articles, I will explore the various dimensions of information and data assets and why mastering an organization’s data assets will define the winners and losers in the next decade. In my next post, I will explore the other data dimensions that drive life sciences organizations, including direct monetization (a controversial topic), return on investment, business value creation through data-driven optimization, and the 800-pound gorilla in the data science room – AI.

References

- Mackie, C., Intangible Assets: Measuring and Enhancing Their Contribution to Corporate Value and Economic Growth: Summary of a Workshop. 2009, The National Academy of Sciences: Washington, DC, USA.

- Brown, A., et al., The Value of Intangible Assets of Corporations Worldwide Rebounds to an All-Time High of USD 80 Trillion in 2024, W.I.P. Organization, Editor. 2024. https://www.wipo.int/en/web/global-innovation-index/w/blogs/2025/the-value-of-intangible-assets-of-corporations

- Smeltzer, M.P. and M.A. Ray, Statistical considerations for outcomes in clinical research: A review of common data types and methodology. Exp Biol Med (Maywood), 2022. 247(9): p. 734–742.

- Sloan Partners, The Growing Importance of Big Data & Data Science in Life Sciences & Healthcare, in Sloan Partners – Insights. 2024, Sloan Partners: https://slonepartners.com.